Forex trading requires a keen understanding of price action patterns. These visual formations indicate potential market shifts, allowing savvy traders to exploit these fluctuations for success. By analyzing various patterns like head and shoulders, double tops and bottoms, and flags, traders can spot potential buy or sell signals. Mastering price action requires practice, as it demands careful observation, pattern recognition, and a sound trading strategy.

Unlocking Hidden Trends with Technical Indicators

Technical indicators are powerful tools for traders seeking to identify hidden trends within financial markets. These analytical gauges analyze price and volume data to generate signals that indicate potential trading opportunities. By employing a variety of technical indicators, traders may achieve valuable insights into market momentum.

- Moving averages filter price fluctuations, revealing underlying trends.

- Relative strength index (RSI) measure volatility, flagging potential overbought or oversold conditions.

- Trendlines define areas of significant support/resistance.

By combining multiple technical indicators, traders have the ability to create a more comprehensive view of market conditions, ultimately leading to improved trading decisions.

Understanding Forex Charts: A Beginner's Guide

Diving into the world of forex trading can seem daunting, especially when faced with complex charts. These visual representations depict currency price movements over time, providing invaluable insights for traders. However, grasping how to read these charts effectively is crucial to success in forex trading.

Begin your journey by familiarizing yourself with the primary chart types: line, bar, and candlestick. Each offers a distinct perspective on price action, allowing you to identify patterns. Mastering these basics will equip you to interpret forex charts with confidence and make strategic trading decisions.

Mastering Technical Analysis for Steady Gains

Unlocking consistent profits in the volatile markets requires a keen understanding of technical analysis. Successful traders harness a diverse set of strategies to predict price movements. One popular approach involves interpreting previous data through charts, seeking to identify common formations that may signal future price action.

- Fundamental analysis

- Bollinger Bands

- Breakout strategies

Remember that technical analysis is not a foolproof system. Markets are multifaceted, and elements beyond price trends can influence market movements. Therefore, it's crucial to hone a disciplined approach that combines technical analysis with prudent trading practices for successful results.

Unveiling Fibonacci Retracements in Forex Trading

Fibonacci retracement levels are a popular technique used by forex traders to identify potential resistance points within price movements. These levels are derived from the Fibonacci sequence, a mathematical pattern where each number is the sum of the two preceding ones.

By these retracement levels, traders can estimate potential reversals in price movements. Fibonacci retracement levels are often used in combination with other technical indicators to support trading decisions.

A common practice is to insert Fibonacci retracement lines on a chart, connecting the peaks and troughs of a recent price swing. The resulting levels are typically expressed as percentages: 23.6%, 38.2%, 50%, 61.8%, and 100%. Traders often look for price levels to revert off these retracement levels, suggesting a potential shift in the existing trend direction.

However, it's crucial to remember that Fibonacci retracements are not infallible. They should be used as a part of a broader trading plan and synthesized with other technical and fundamental here analysis.

Dissecting Advanced Chart Patterns for Profitable Forex Trades

Mastering the volatility of the forex market requires more than just fundamental analysis. Savvy traders spot the power of advanced chart patterns, which offer valuable signals into potential price actions. By interpreting these intricate formations, you can enhance your trading strategy and increase your chances of profitable trades.

- For example, Elliot Wave Theory provides a framework for predicting market cycles based on recurring patterns.

- Similarly, candlestick patterns like Doji and Engulfing can reveal key turns in momentum.

- Furthermore, understanding trendlines, support and resistance levels, and harmonic patterns can help you predict future price movements. }

Through dedicated study and practice, you can refine your ability to interpret these advanced chart patterns. Remember, consistent application of this knowledge, coupled with sound risk management principles, is essential for long-term success in the dynamic forex market.

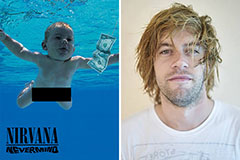

Spencer Elden Then & Now!

Spencer Elden Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Marcus Jordan Then & Now!

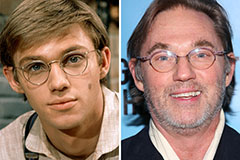

Marcus Jordan Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!